Introduction

Regardless of the types and levels of projects undertaken by our member-contractors, it has always been (and always will be) essential that the quality of workmanship, materials and service offered to our registered clients will always remain consistently high…no matter what.

But here’s the problem…

How can a contractor offer competitive pricing without negatively affecting such a high degree of quality and service?

How can a contractor offer competitive pricing without negatively affecting such a high degree of quality and service?

Typically, when a contractor begins to overly cut pricing to accommodate a client’s budget…the project suffers. Corners are cut, cheaper materials are purchased, arguments take place back and forth, and everyone winds up disgusted and unhappy at the end.

Problem Solved…!

In 2015, The Renovation Co-op established The Subsidy Discount Program, which was designed to help Member-Contractors and Architectural Specialists maintain competitive pricing, without being forced to lower their fees, (which always reduces the quality of workmanship and/or materials).

Sources of Funding…

Where the Money Comes From…

Sources of Funding

The Subsidy Fund is supported through both scheduled and non-scheduled, 3rd-party payments and contributions as follows:

* A percentage of monthly administration fees paid by all member-service partners. (Administration fees include member-access to the Co-op’s proprietary, renovation-related systems, such as Renovation Accounting & Estimating Programs, along with subscription fees related to our Member-Bidding Systems, etc.)

* A percentage of monthly administration fees paid by all member-service partners. (Administration fees include member-access to the Co-op’s proprietary, renovation-related systems, such as Renovation Accounting & Estimating Programs, along with subscription fees related to our Member-Bidding Systems, etc.)

* Recurring contributions from independent distributors, manufacturers and related businesses within the Construction Industry across Ontario.

* Recurring contributions from independent distributors, manufacturers and related businesses within the Construction Industry across Ontario.

* Limited marketing support from the Financial Services & Real Estate sectors throughout Ontario and selected areas across Canada.

* Limited marketing support from the Financial Services & Real Estate sectors throughout Ontario and selected areas across Canada.

How Subsidy Funds are Distributed…

Throughout each month, portions of the Subsidy Discount Fund are used as discretionary, mini-“grants” which get credited toward the contract price of selected General Contracting and Architectural projects on a case-by-case basis.

The amount of the “grant” approved for each subsidy request is carefully determined, using a series of protocols related to the project itself, such as the type and scope of the work, the competitive nature of the project, as well as the project’s geographical location, etc.

The program’s Fund Managers maintain a vigilant watch over the daily availability of these funds throughout the month, in order to accommodate as many funding requests as possible in a fair and balanced manner.

The contractor signs his/her agreement with the homeowner for the final discounted price, and the contractor is then reimbursed, or subsidized directly by the fund with the amount of the discount given to the client.

The contractor signs his/her agreement with the homeowner for the final discounted price, and the contractor is then reimbursed, or subsidized directly by the fund with the amount of the discount given to the client.

Subsidy Withdrawal Policy:

Upon the completion of an Online Estimate Review conducted by your assigned Client Service Rep, any subsidy funds that may be offered as part of your estimate will be removed 5 business days following the date of the review. (see Estimating Procedures)

Reason: When a member-contractor signs the final agreement with the client, the final price is reduced by the Subsidy amount.(as displayed in the above example)

The approved Subsidy amount is then segregated and placed on “hold” for a period of 5 business days, pending a deposit or contract signature.

If a deposit is not submitted or a contract agreement is not signed between the client and the contractor by the withdrawal date, the subsidy amounts are automatically withdrawn from the estimate and placed back into the program’s general “pool” of funds.

The Subsidy Discount Program enables The Renovation Co-op to attract higher quality, professional service-members, regardless of the type and level of service that is performed.

In other words…the Subsidy Program makes no distinction between its support for General Contractors who regularly perform high-level projects such as large additions, custom homes, etc…and those General Contractors who specialize in smaller types of projects (such as kitchens, bathrooms & basement renovations, as well as entrances, porches, garages & carports, etc).

All Subsidy Funds, rebates and credits are spread out evenly to accommodate all types and levels of projects, which gives The Renovation Co-op a much wider fulfillment capacity for its registered clients.

The benefits to both the client and the member-contractor are as follows:

1- The client is only responsible to the member-contractor for the final, discounted contract price.

2- The contractor or architectural-member gets credited back, or “subsidized” by the Subsidy Fund for the approved, discounted amount.

The Subsidy Discount Program supports our member-Contractors and Architectural Specialists by reimbursing (or subsidizing) them through the use of 3rd-party Support Funds, instead of having to lower their contract price, which always leads to a lower quality of service and/or the use of cheaper-grade materials.

Managing the Funds…

Who manages the Subsidy Program?

The Canadian Renovation Funding Program is responsible for the day-to-day management of The Subsidy Discount Program.

The program was first established in 2016 for two purposes:

1- * Subsidy Fund Management & Distribution

The Renovation Funding Program is responsible for the complex management of the Subsidy Discount Program, which includes the monthly allocation of all Subsidy Funds to each of the Co-op’s individual rebate and credit programs.

When a subsidy or rebate request is made on behalf of a specific project, the program’s Funding Managers determine the amount of the subsidy or rebate (subject to availability upon the request), and from which allocated program the funds will be drawn.

Note: There are specific types of rebates and credits that are guaranteed and not subject to any short-term availability. These will be noted within your Online Estimate Review. (see Estimating Procedures

2- * Financial Service Recommendations

The Renovation Funding Program also acts as as a non-profit, free advisory service for registered clients who require some form of mortgage financing or other financial service

Following a personal interview with the client, a Funding Program Specialist will recommend a best-matched professional service provider.

This may include a recommendation to one or more of the following Co-op approved Professional Services:

* Mortgage Broker

* Realtor

* Accounting & Bookkeeping

* Legal Services

* Financial Consulting

* Investment Planning

Note: Neither the Renovation Co-op, nor any of its affiliated companies and/or individuals, participate in the arrangement of mortgage financing or any other related professional services. Only licensed individuals and/or companies are qualified to perform these services.

The Renovation Co-op accepts no responsibility whatsoever with regard to any services purchased from such recommended individuals or services.

In addition, The Renovation Co-op accepts no liability whatsoever for losses or other issues related to the use of the Co-op’s proprietary Management Platform by any user.

Privacy Policy: Clients are never solicited to make a purchase from such recommended services, and must personally make a request directly to The Co-op for such recommendations through the client’s assigned Client Service Rep.

For further information see Renovation Funding Program

If you Purchase a Mortgage…

Mortgage Broker Fee Credit

When you purchase a mortgage (any type of mortgage loan) through a Co-op approved Mortgage Broker, and your renovation project is performed by a Co-op Member-Contractor, a Mortgage Broker Fee Credit will be issued toward the contract price.

When you purchase a mortgage (any type of mortgage loan) through a Co-op approved Mortgage Broker, and your renovation project is performed by a Co-op Member-Contractor, a Mortgage Broker Fee Credit will be issued toward the contract price.

These limited Credits are allocated by The Subsidy Program to help our registered clients offset the cost of obtaining mortgage loans to pay for renovation projects.

If available at the time of your estimate, the approved credit amount will be deducted from the total cost of your renovation project (regardless of any other credits, subsidies or rebates that may be offered as part of your estimate).

Terms & Conditions:

* Renovations must be performed by a Co-op Member-Contractor.

* The mortgage must be purchased through a Co-op Approved Broker

* If you are obtaining your mortgage loan for a purpose other than renovations, (eg: Debt consolidation, New Home Purchase, etc.) you will still have permanent access to this credit (subject to availability) when you purchase any (General Contractor-level) renovation project through The Co-op within a 2-year period from the date of the mortgage closing.

Note: All Mortgage Broker Fee Credits are drawn from the general pool of Subsidy Funds. They are not drawn from the client’s Renovation Credit Account.. For further details see The Renovation Credit Program

see also : Mortgage Closing Fee Credit

Mortgage Cost Support

Mortgage Closing Fee Credit

When your mortgage closing is completed by a Co-op-approved Real Estate Law Firm, and your renovations are performed by a Co-op approved Member Contractor, the contract price will include a Mortgage Closing Fee Credit, which will be deducted from the final price.

The Mortgage Closing Fee Credit is a separate credit allocated (in limited amounts) by the Subsidy Program to help offset the cost to our registered clients in obtaining mortgage lending to pay for their renovation project.

Terms & Conditions:

* Renovations must be performed by a Co-op Member-Contractor.

* Your mortgage must be purchased through a Co-op Approved Broker

* If you are obtaining your mortgage loan for a purpose other than renovations (eg: Debt consolidation, New Home Purchase, etc.), you will still have permanent access to this credit (subject to availability) when you purchase a (General Contractor-level) renovation project through The Co-op within a 2-year period from the date of your mortgage closing.

see also : Mortgage Broker Fee Credit

Note: Mortgage Broker Fee Credits and Mortgage Closing Fee Credits are allocated separately by the Subsidy Program. As they are done so in limited amounts, such credits (along with any other subsidies, rebates, credits etc.) will be included in your estimate based upon availability at the time of your Online Estimate Review.

Subsidy Fund Withdrawal Policy:

As per your Online Estimate Review, which is conducted by an assigned Service Rep (see Estimating Procedures) the primary subsidy amount shall be withdrawn after 5 (five) business days following the Review conducted by your assigned Client Service Rep

Not included in the funds withdrawal are the following:

* Mortgage Brokerage Fee Credit

* Mortgage Closing Fee Credits

* Architectural Rebate

* Renovation Credit Allowance see Renovation Credit Program

$1500

Architectural Rebate

As previously mentioned, all architectural services are sold separately. When you purchase your Architectural Drawings and Permit Processing through a Co-op member-designer, you are never locked into having the actual work performed through The Renovation Co-op.

You control your own set of drawings, which enables you to freely obtain estimates from any contractors (including The Renovation Co-op’s own member-contractors).

This also means that any contractors who quote on your project must do so by estimating on the same set of Final Permit Drawings, leaving no room for guesswork, “game-playing,” or any unreasonable extra fees charged after your project has commenced.

However, if your project is completed by an approved Member-Contractor, you will receive an Architectural Rebate of up to $1500, which will be deducted from your final contract price.

The Architectural Rebate will be applied regardless of any other subsidies or discounts that may be offered as part of the member-contractor’s price.

The Architectural Rebate will remain in your account indefinitely until it gets applied toward the purchase of renovations (only for the same work the permit has been issued for).

Introduction

As mentioned in other sections, the Canadian Renovation Funding Program (see Funding Program) is responsible for the day-to-day management of The Co-op’s Subsidy Discount Program.

The Renovation Funding Program also acts as a free advisory service for clients seeking non-renovation-related) professional services such as Mortgage Financing, Real Estate, Financial Consulting, etc.

As an additional incentive for the purchase of renovations, The Renovation Credit Program was created in 2018. This revolutionary program enables registered clients to earn substantial credits when purchasing any Co-op-approved services (non-renovation-related) that are recommended through The Renovation Funding Program.

Upon registering as a client, your online account will contain a link to your Renovation Credit Account, which will normally display an initial balance of “$0.“

When you complete a purchase from a Co-op-approved, Professional Service Partner (Mortgage Broker, Realtor, Insurance Broker, etc.) an amount of between $500-$3,000 will be automatically added to your Renovation Credit Balance. see Related Professional Services

How Renovation Credit is applied to your Estimate

Portions of your Renovation Credit can be applied against the cost of a project that is purchased through a member-contractor. (applicable toward General Contracting projects only).

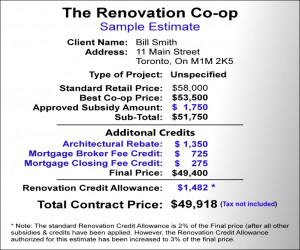

The following portion of a sample Online Estimate Review includes the following credits:

* Subsidy Fund Discount

This credit has been approved by The Renovation Funding Program and drawn from the Co-op’s general “pool” of Subsidy Discount Funds. Please note: All allotted Subsidy amounts will be withdrawn from the estimate 5 days following the date of client’s Online Estimate Review conducted by an assigned Client Service Rep. (pending deposit and/or contract signature) see Estimating Procedures

* Additional Credits

Architectural Rebate:

This credit/rebate will remain permanently within the client’s account until it is used towards the same renovation project for which the client’s drawings & permit were provided.

Mortgage Broker Fee Credit

Mortgage Closing Fee Credit:

If the client has purchased a mortgage from a Co-op-approved Broker, and the loan is to be used (in full or in part) to pay for a renovation project, these credits will remain permanently within the client’s account until they are applied toward a completed renovation project (if the renovations are performed by a member-contractor).

In other words, these two credits are not restricted to being applied only towards the originally-planned renovations that the loan was applied for.

For example, the client may have had to arrange mortgage financing to consolidate his/her debts first, where the further financing of the renovations may not have been possible.

* Renovation Credit Allowance

Subsidy Discounts vs.

Renovation Credit Allowance

When an approved Subsidy Discount is offered within your estimate, the amount is normally withdrawn 5 business days following your Online Estimate Review (pending a deposit or signed contract.). see Estimating Procedures

However, none of the credit earned within your Renovation Credit account will ever be withdrawn or depleted from your account until it is applied towards the completed sale of one or more general contracting projects.

Related Professional Services

As one of the many benefits offered to the Co-op’s registered clients, The Canadian Renovation Funding Program offers unlimited, free access to several Co-op approved Partner-Services.

These selected service professionals include licensed Mortgage Brokers, Realtors, Insurance Brokers, Financial Accounting and Legal Services.

Upon the purchase of one or more of the following eligible services, a credit will be added to your Renovation Credit Balance as follows:

Mortgage Financing

Regardless of whether you want to purchase renovations, consolidate your debts, apply for a line of credit, or if you need emergency cash for an unexpected expense, all registered clients have access to a free Mortgage Broker Referral Service offered through The Canadian Renovation Funding Program.

Upon the client’s request, a Funding Program Specialist will identify and recommend a specific, Co-op-approved Mortgage Broker who regularly specializes in the type of loan product that best fulfills the client’s personal needs.

This targeted “pinpointing” of a specific broker’s unique experience greatly increases the client’s chances of quickly obtaining the most appropriate type of loan that fits his or her needs, and not the other way around.

Mortgage Services

Eligible Renovation Credit: $2,500

———————————————-

If you plan to sell your existing home and/or move to a new one, the Co-op will recommend an approved, local Realtor who has personal familiarity with current real estate trends occurring within your own area.

Note: All Real Estate professionals that are recommended through The Renovation Co-op have been heavily screened and vetted, with a strong emphasis placed on the realtor’s experience and professional attitude toward long-term relationship-building with his/her clients.

Historically, throughout the many real estate booms and cycles undergone within most major cities such as Toronto, the marketplace becomes over-saturated with new, inexperienced real estate agents who have entered the profession for the purpose of quickly “cashing in” on such major surges.

However, when the real estate market begins to “fizzle”, such agents likewise tend to “fizzle out”.

By a sharp contrast, each participating realtor selected to work with The Renovation Co-op’s registered clients have proven himself/herself to be totally career-oriented, and has personally experienced all of the highs and lows related to past economic and real estate market conditions over the last 15-20 years.

Real Estate Services

Eligible Renovation Credit: $3,000

Financial Planning Services

As many clients have opted to convert their Basement or 2nd Floor into a legal rental apartment, the income generated from such rentals can grow exponentially when placed into a safe, long-term investment strategy.

Upon your request, the Renovation Funding Program will provide you with a direct recommendation to a Co-op-approved Financial Planner or Investment Specialist who can help you achieve your long-term investment goals.

Financial Planning Services

Eligible Renovation Credit: $1,500

Note: There are several types of residential renovations that are designed to create Rental Income. These include Basement Apartments, converted 2nd-Floors/Attic Rental Apartments and Laneway Rental Suites.

Accounting & Tax Services

Accounting & Tax Services

As part of its related Professional Services program, The Renovation Co-op will recommend a best-matched Bookkeeping Service and/or Tax Specialist to any registered client who requests such a service.

These recommended Accounting & Tax specialists provide quick, personalized service for your personal and/or business needs.

Accounting & Tax Services

Eligible Renovation Credit: $1,000

Insurance Services

Insurance Services

Need Homeowner’s Insurance? Additional Health Coverage? Auto Insurance or self-employed Liability Insurance?

The Renovation Funding Program will personally recommend a Co-op-approved Insurance Specialist who will provide you with the best and most cost-effective coverage available anywhere.

Insurance Services

Eligible Renovation Credit: $1,000

Legal Services

Legal Services

Upon your request, the program will recommend a Co-op-approved Law Firm specializing in one or more of the following:

* Bankruptcies

* Criminal Law

* Corporations

* Immigration

* Family Law

* Real Estate

* Civil Litigation

Legal Services

Eligible Renovation Credit: $1,000

Selling your home?

If you sell your home and move to another location, your Renovation Credit Balance will be transferred to your new home and applied toward future renovation purchases.

Or, as an added incentive for the sale of your existing home, you can “sweeten the deal” by opting to transfer your Credit Balance directly to the buyer.

Upon your request, we will send you a “Certificate of Transfer” to your buyer’s name.

Questions?…Call 647-800-9721

Estimating Procedures

To help facilitate the flow of private, secured information and communications between our member-service partners and their clients, we’ve developed our own proprietary, Renovation Management Platform.

This unique system enables all project-related information to be entered, updated and tracked 24/7 by both registered clients and Co-op members alike.

For example…one of the biggest issues that most contractors and their clients face is the lack of adequate communications between the two parties throughout the estimating process, and as the project proceeds along its various stages of production.

For example…one of the biggest issues that most contractors and their clients face is the lack of adequate communications between the two parties throughout the estimating process, and as the project proceeds along its various stages of production.

When you request an estimate, you will have access to your own personal secured account, which will include updated status reports of the estimate process, as well as status reports on construction, progressive payment reports etc, along with the balance of your Renovation Credit Account (see Renovation Credit Program)

Please Note: If your project requires a Building Permit, The Renovation Co-op will be unable to process an estimate for your renovations until you have submitted a copy of the final drawings and a stamped permit.

If you do not have your own architect, please request an estimate for your Drawings and Permit Processing.

If you do not have your own architect, please request an estimate for your Drawings and Permit Processing.

Note: If you hire a Co-op Member-Architectural Specialist, you will receive a rebate of up to $1,500. see Architectural Rebate

The following procedures assume that a permit has already been acquired:

Step 1: Project Assessment Report

Step 2: Submission of Bid Request

Step 3: Review of Bid Responses

Step 1: Project Assessment Report

For your Basement Apartment Renovation project, a Senior-Level Contractor is selected to conduct an Initial Site Examination of the property. He or she will first review a copy of the client’s Final Permit drawings, and then personally review the overall project with the homeowner(s).

Following the Initial Site Examination, the senior contractor submits a Project Assessment Report to the Co-op’s Bid Preparation Team.

Step 2: Preparation & Submission

of a Bid Request

Based upon the Project Assessment Report submitted by the senior-level contractor, the Co-op’s Bid Preparation Team determines the type and level of general contracting service that will be required to complete the client’s project.

A Bid Request is then submitted to a carefully targeted group of member-contactors who regularly perform the same type and level of work required by the client.

Step 3: Review of Bid Responses

Note: While it is important to ensure that all bid responses are submitted quickly, the targeted group of contractors will always be given adequate time to check availability and pricing from their sub-trades, suppliers, etc. before committing to a price.

Step 4: Automatic Request for Subsidy Funds

Upon completion of the bidding process, an automatic request is sent to the Canadian Renovation Funding Program to obtain any Subsidy Discount Funds, Rebates or Grants that may be available for the project. (see Subsidies, Rebates and Incentives)

The approval of subsidy funds for each request normally takes 4-6 hours, and is determined based upon the availability of funds at the time of the request, as well as the type of project involved and its location.

Step 5: Online Estimate Review

Upon completion of the bidding process and the automatic request for Subsidy Funds, a telephone appointment is arranged between a Co-op Service Rep and the client to simultaneously review the completed estimate.

Throughout this 5-minute Online Estimate Review, the rep verifies that the client fully understands what is being presented, and that the client can properly navigate through the estimate.

The client’s Online Estimate is divided into 2 segments:

Scope of Work: Provides a full, detailed description of the work that is to be performed

Contract Price: Displays the Final Sale Price after deductions from approved subsidy funds and rebates have been calculated, along with the portion of Renovation Credit that can be applied (if available from within the client’s Renovation Credit Account). see Renovation Credit Program